Terrydale Capital, a growing commercial real estate financing firm based in Dallas, Texas, is making strides in offering a comprehensive range of lending solutions and strategic advisory services for investors nationwide. Built on a foundation of speed, flexibility, and in-depth market expertise, the firm has positioned itself as a strong partner for commercial borrowers who seek not just capital, but effective solutions.

From bridge loans and hard money lending to full-scale development financing and mezzanine structures, Terrydale Capital offers a variety of financing options tailored for today’s competitive market. Their approach integrates access to a broad lender network, careful underwriting, and a client-first mindset. It’s not just about reaching the closing table—it’s about doing so efficiently, with better terms and fewer unexpected hurdles.

Streamlined Loan Programs with Nationwide Reach

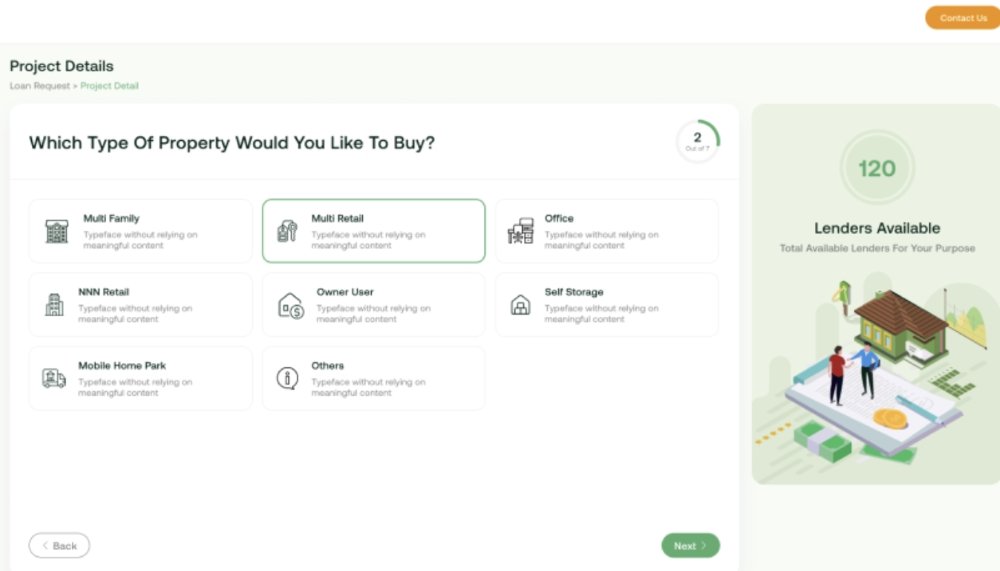

Terrydale Capital has developed a reputation as a one-stop shop for commercial real estate investors. Its loan programs cover major asset classes, including multifamily, industrial, retail, self-storage, office, land, and specialty-use properties. With the capacity to fund deals ranging from $500,000 to $250 million, the firm blends institutional-level capabilities with personalized service.

For time-sensitive deals, Terrydale’s hard money services offer speed and reliability. By leveraging strong relationships with private capital sources, the firm facilitates faster closings with reduced bureaucracy—suitable for acquisitions, distressed opportunities, or value-add projects. For more complex financing, the firm structures bridge, mezzanine, and preferred equity solutions tailored to each investor’s specific goals.

Advisory with an Edge

Terrydale Capital offers more than just lending. Its advisory services provide clients access to a knowledgeable team that understands the entire commercial real estate lifecycle—from acquisition and underwriting to development and refinancing. Investors gain access to custom capital plans, deal strategy insights, financial modeling, and direct connections to qualified lenders—all designed to help improve project viability and enhance investor returns.

This consultative approach proves particularly useful for projects with multiple moving parts—such as land development, repositioning, or mixed-use redevelopments—requiring strategic planning and efficient execution. Terrydale’s guidance brings structure to each phase, helping clients navigate complexities and take advantage of market opportunities.

Terrydale Live: Real-Time Lending Intelligence

A core element of the firm’s tech-forward approach is Terrydale Live, a proprietary digital platform offering real-time access to rate quotes, lender insights, and off-market opportunities. The platform compiles up-to-date market conditions and lending programs from over 800 lender relationships, giving borrowers a potential advantage in a competitive market.

Rather than relying on outdated spreadsheets or rate sheets, clients can see live lender interest and match their deals to available capital sources. It’s an approach focused on transparency, speed, and intelligence—all in one accessible place.

Photo Courtesy: Terrydale Capital

A Team That Gets Deals Done

Terrydale’s internal process is designed for efficiency and clear communication. From the initial quote to final closing, the team ensures that all parties stay aligned, pushing each deal forward with confidence. This commitment to service has contributed to the firm’s track record of success, earning repeat business from experienced operators across the country.

Built to Scale with the Market

As interest rates fluctuate and capital markets face uncertainty, Terrydale Capital relies on its strengths: agility, creativity, and strong lender relationships. While traditional banks may scale back, Terrydale continues to secure competitive financing by tapping into a broad network of banks, credit unions, debt funds, and private lenders.

Whether dealing with rate volatility or uncovering potential value in properties, Terrydale’s model is designed to move quickly and adapt to changes. The firm’s commitment to its clients, its processes, and the end results remains steadfast.

About Terrydale Capital

Founded in 2018 and headquartered in Dallas, Terrydale Capital provides nationwide commercial real estate financing and strategic advisory for a wide range of asset classes. With over 1,500 closed transactions and a combined 60+ years of experience, the firm continues to be a key player in the commercial real estate capital solutions sector, focusing on innovative approaches and strong execution.

Disclaimer: This content is for informational purposes only and is not intended as financial advice, investment advice, or any other type of professional advice. You should consult with a qualified financial advisor or other relevant professionals before making any financial decisions.